Seasonal Inventory Growth Meets Steady Demand

September 7, 2025

OTTAWA, ON – Ottawa’s housing market in August 2025 offered buyers greater choice amid subtle signs of shifting dynamics. Last month, demand remained healthy, while supply continued to increase. Active listings climbed to 3,971, approximately 37% above the five-year August average.

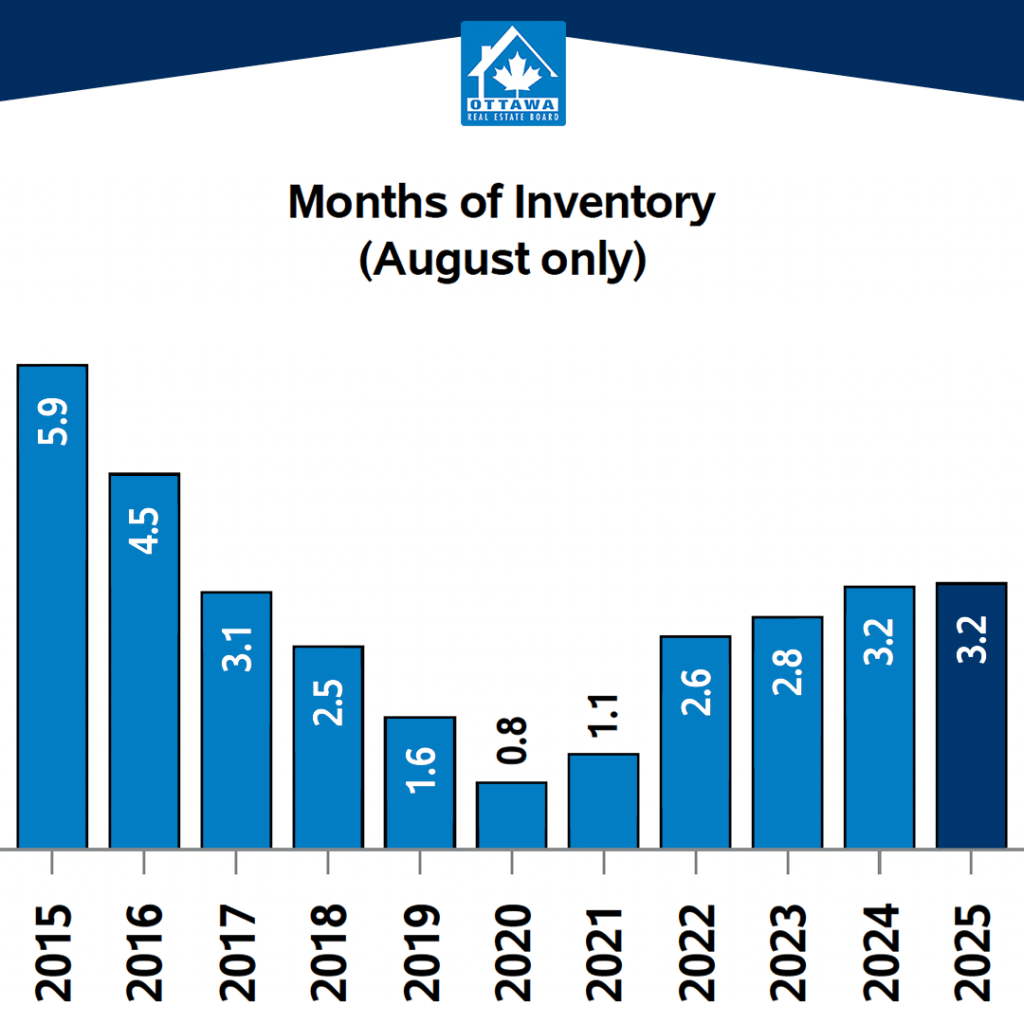

This increase in inventory, while worth monitoring, is not currently a cause for concern. Ottawa’s real estate market follows well-established seasonal cycles, with late summer typically bringing a build-up of available listings ahead of the busy fall market. Both the sales-to-new-listings ratio of 58.3% and 3.2 months of inventory indicate that demand is keeping pace with supply, maintaining balanced market conditions.

It’s also important to recognize that 2020 and 2021 were historic outliers, with unusually low active listing levels that distort the five-year average. Excluding those years and instead referencing the pre-pandemic 2018 and 2019 figures, August 2025 inventory sit roughly 33–34% above the revised five-year trend — a more accurate measure of current market standing relative to historical norms.

Property-type trends continue to diverge. Single-family home HPI benchmarks remain broadly steady, and townhouse values are showing gains, while the condominium segment, particularly in the downtown core, remains comparatively soft. These variations present differing market opportunities depending on location, property type, and price point.

For buyers, the current combination of elevated inventory and steady demand presents a strategic window: more choice and greater negotiating power are available for those in a position to act on it. Meanwhile, broader provincial trends — such as slowing sales and rising supply elsewhere in Ontario — remain factors to watch. There are emerging signs of a potential turnaround in these markets, that could support improved conditions in the months ahead.

OREB will continue to monitor these developments closely to ensure Members and consumers remain informed as Ottawa’s market evolves.

“August was an active month for Ottawa’s housing market, with overall prices trending upward and sales activity stronger than in recent years as the summer season winds down,” said Tami Eades, OREB President-Elect. “While we continue to see different price movements across segments, the broader picture points to renewed momentum in the Ottawa Region as buyers and sellers alike re-engage ahead of the fall market. Ottawa’s market reflects balanced conditions, though we are mindful of broader economic factors—such as federal employment trends and U.S. trade policies—that could affect our market in the months ahead.”

Residential Market Activity

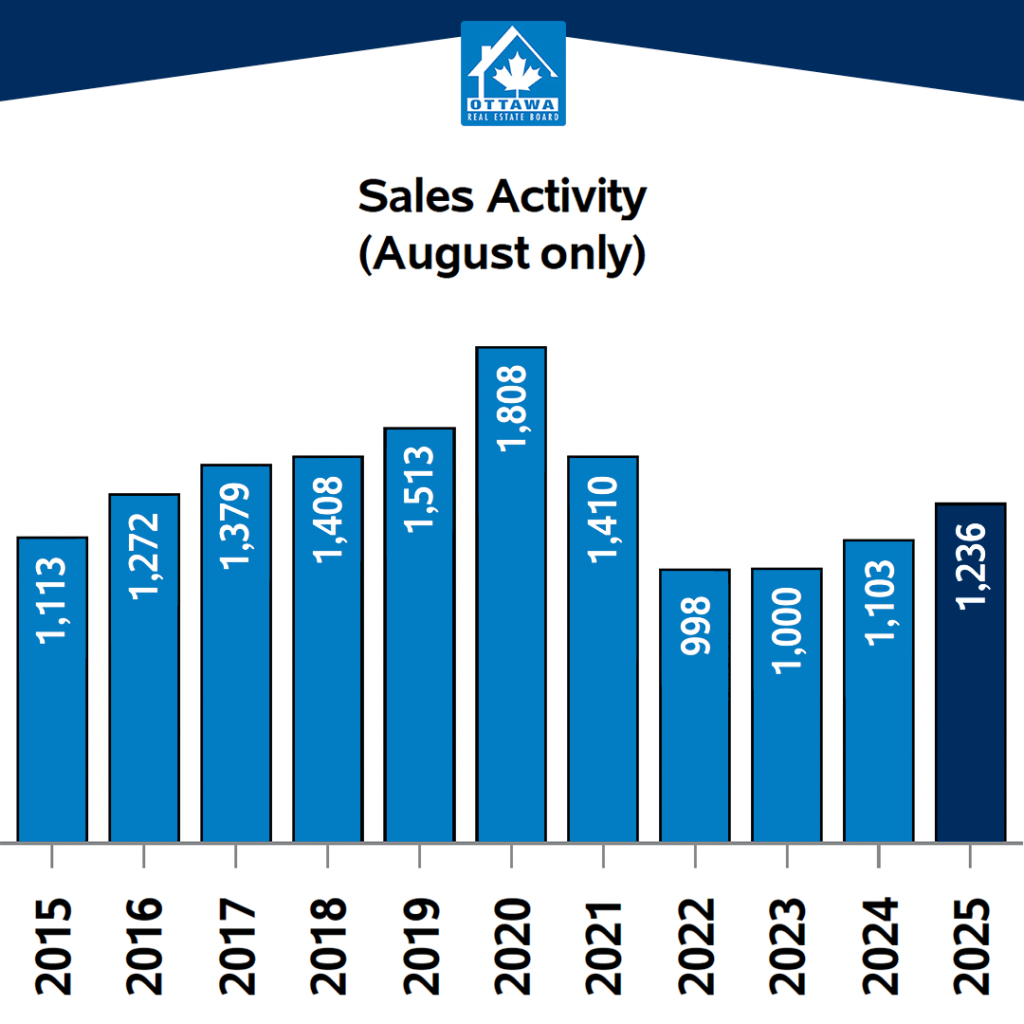

In August 2025, a total of 1,236 homes were sold across the Ottawa Real Estate Board (OREB) region. While down from 1,318 units in July 2025 and 1,602 in June 2025, this represents a 12.1% increase compared to August last year. Two consecutive months of slower sales is consistent with the spring to summer market seasonality, particularly as we are already approaching what is typically a more active fall market.

Looking at the bigger picture, there have been 9,936 home sales so far this year, which is 4.1% higher than at this time in 2024.

The average sale price for all sold listings in August was $686,536, up 3.6% from last year.

This year, the average year-to-date price is $700,828, a 3% increase over the first eight months of 2024.

Altogether, the total value of homes sold in August reached approximately $850 million, up 16% year-over-year, with the housing sector continuing to be one of the major drivers of the overall Ottawa economy.

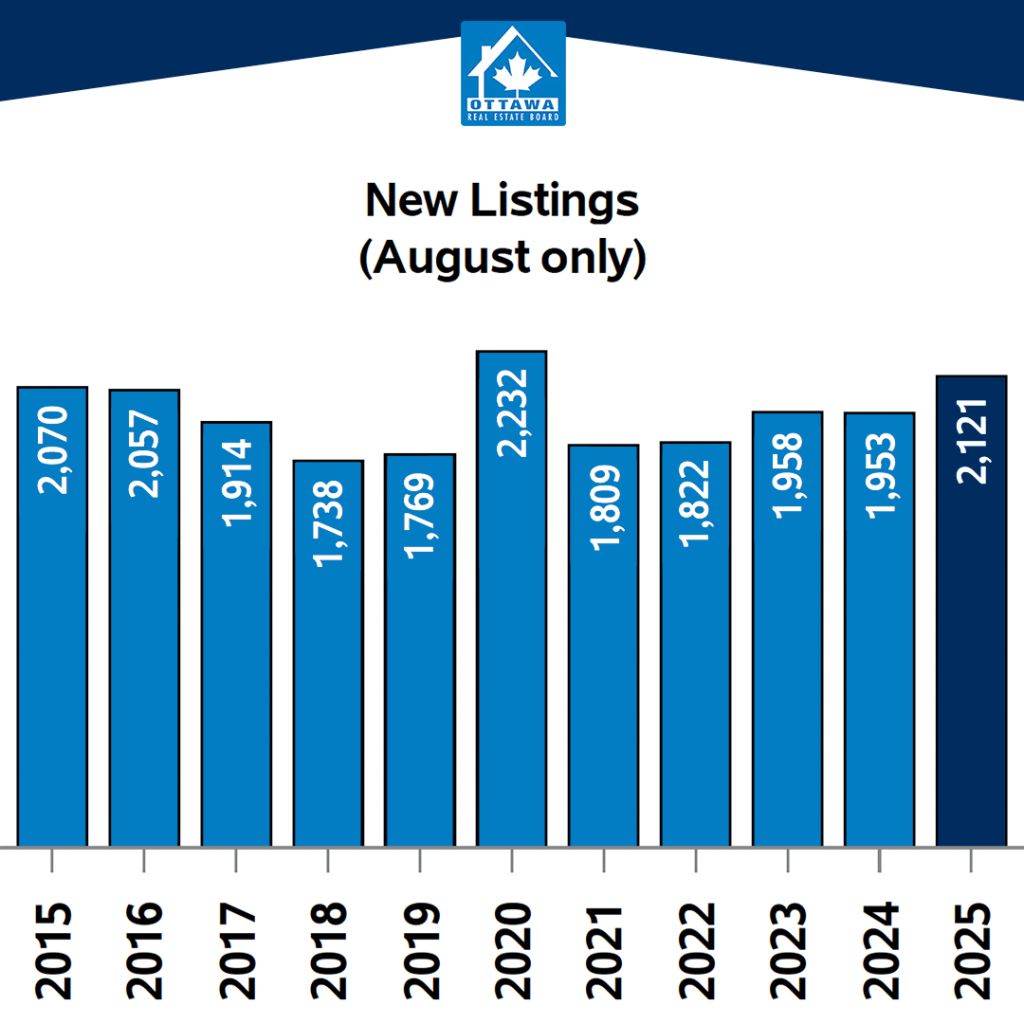

On the listing side, there were 2,121 new residential listings added in August, a significant 8.6% increase compared to last year, and 3,971 active listings on the market, up 13.3% from August 2024, and 37.1% above the five-year average for this time of year.

Finally, the months of inventory—a measure of supply— sits at 3.2 months, which is unchanged from last month and identical to last August’s metric as well. 3.2 months of inventory is typically understood to be an indicator of what is considered a balanced market. Another indication that despite Ottawa’s high active listing count that demand is currently keeping pace with supply.

MLS® Home Price Index

As for prices, the MLS® Home Price Index (HPI) composite benchmark price in Ottawa was $633,000 in August, a modest 1.5% increase year-over-year.

If we break that benchmark price down by property type:

- Single-family homes came in at $700,100, up 1.5%.

- Townhouses saw the biggest jump — up 8.3% to $466,200.

- Apartments, on the other hand, dipped slightly, — down 1.1% to $412,300.

For media inquiries, please contact:

Dave Holmes, Manager, Marketing and Communications

613-225-2240 ext. 232 | dave@oreb.ca