Market Overview

Ottawa’s residential market entered 2026 on a balanced footing. Inventory levels remain higher than in recent years, giving buyers more choice, while sellers continue to adjust to conditions that reward accurate pricing and patience. Benchmark prices are down year over year across all housing types, with softer conditions most evident in townhouses and apartments. Detached homes continue to show greater price stability. Overall, January’s data points to a market that is operating more evenly, rather than one under broad-based pressure.

“What January is showing us is a market that’s adjusting in a healthy way,” said Tami Eades, President of the Ottawa Real Estate Board. “We’re seeing more choice for buyers, more realism on the selling side, and pricing that’s responding to those conditions without sharp swings. That kind of balance is a sign of stability, not stress.”

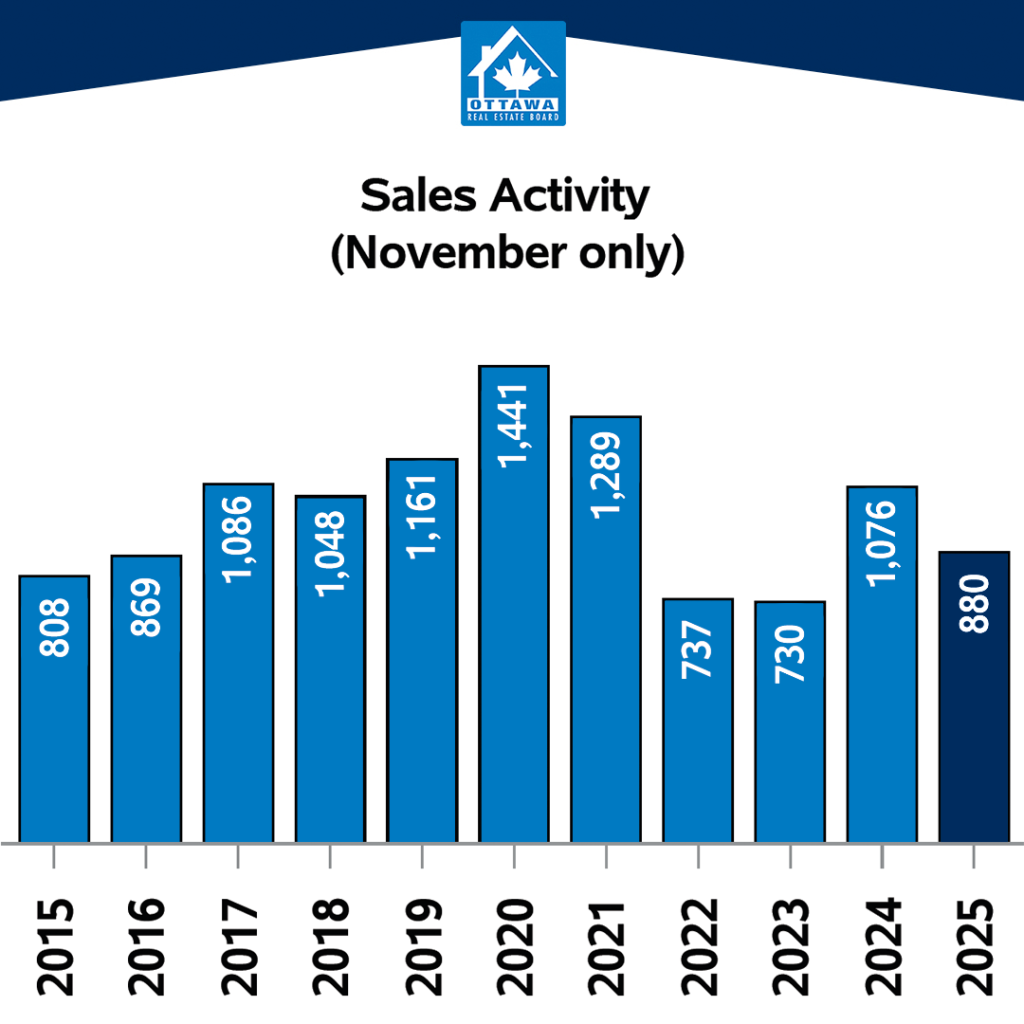

Residential Market Activity

In January, 610 residential properties sold in Ottawa, reflecting a typical post-holiday slowdown while also signalling a steadier start to the year. Sales were 5.6% lower than a year ago but remained within the range of long-term January norms. This points to demand that is still present, even as buyers continue to proceed cautiously amid ongoing affordability considerations.

Pricing activity also reflected seasonal conditions rather than renewed weakness. The average residential sale price was $641,436, down 4.5% from January 2025, a change consistent with winter market dynamics and a more price-sensitive buyer pool. Recent interest rate reductions have begun to ease pressure at the margins. January’s data suggests their impact is appearing first in buyer engagement rather than completed transactions.

The MLS® Home Price Index provides further context. In January, the composite benchmark price declined modestly month over month, with single-family, townhouse, and apartment benchmarks all posting small decreases.

Prices and Market Balance

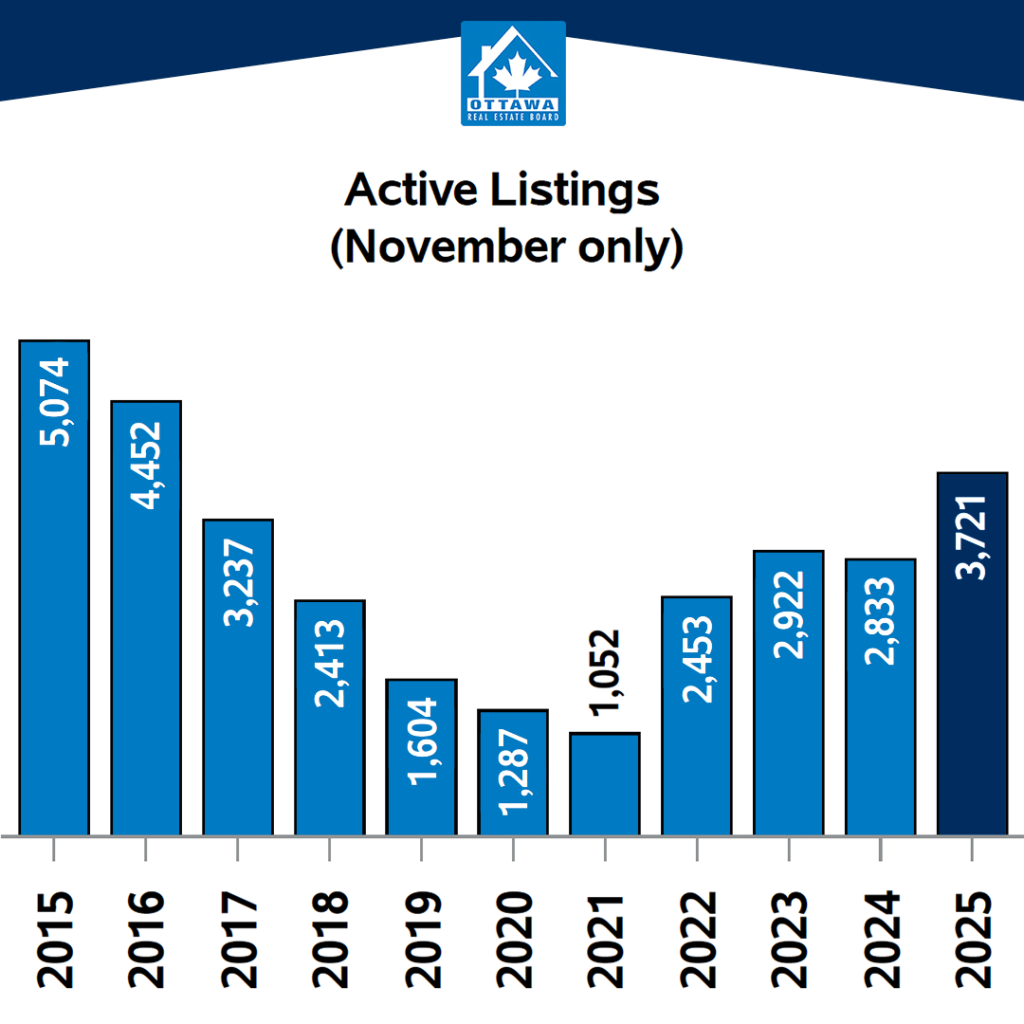

Supply conditions continue to vary significantly by property type. Overall, new listings totalled 1,522 units, up 8.8% year over year, while active listings reached 2,673. This is an increase of 22.7% from last January. Although inventory levels remain elevated compared to recent seasonal norms, growth has slowed, helping to prevent a buildup of excess supply.

With months of inventory at 4.4, Ottawa’s market is operating closer to long-term, pre-pandemic averages. This level of supply is providing buyers with more choice and negotiating flexibility, while still allowing well-priced homes to attract solid interest. Rather than putting sharp downward pressure on prices, current inventory levels are supporting a more balanced market.

Property Type Breakdown

As noted above, differences in market performance by property type continued to shape Ottawa’s market in January.

Single-Family Homes

Detached homes remained the market’s most stable segment, even as winter conditions weighed on overall activity. In January, 276 single-family homes sold, down 13.8% year over year. Supply levels remained comparatively balanced at 4.3 months of inventory, supported by 1,177 active listings, and 663 new listings, essentially flat year over year.

Prices softened modestly. The average sale price was $793,874, down 3.6% year over year, while the median price held at $750,000, unchanged from last January. Together, these indicators suggest that detached home pricing is adjusting in an orderly manner. The single-family benchmark price also edged lower year over year, marking a shift from the modest gains seen late last year; the decline remains limited.

Townhomes

Townhome sales rose to 215 units, up 6.4% year over year, while new listings increased sharply to 487, up 45.8% from January 2025 and well above December’s 176 new listings. Active listings climbed to 708, a 67.0% increase year over year.

As supply increased, leverage has shifted modestly toward buyers. Months of inventory rose to 3.3, and pricing reflected this adjustment. The average townhouse sale price was $536,106, down 3.3% year over year, while the median price declined 3.4% to $560,000. The townhouse benchmark price was down 3.2% year over year, but rose 1.0% compared to December.

Apartments

The apartment segment showed a constructive month-over-month shift in January, marking a contrast to late 2025. In January, apartment-condo sales increased to 95 from 78 in December, and months of inventory decreased to 6.8 from 7.9, an indication of stronger absorption.

At the same time, supply expanded meaningfully. New listings rose to 312 from 144 in December, and active listings increased to 647 from 617. In other words, January brought a sizeable seasonal influx of condo listings, but improved sales activity helped prevent a further deterioration in market balance.

Pricing in this segment remains the most sensitive anywhere across the Ottawa market. The average apartment sale price was $388,307, down 12.1% from January 2025 and lower than December’s $401,465. While condo pricing continues to adjust, January’s combination of higher sales and lower months of inventory suggests that conditions may be starting to stabilize.

Months of Inventory:

- Single Family: 4.3

- Townhome: 3.3

- Apartment: 6.8

Looking Ahead

January’s data reflects a familiar winter pattern, with slower sales and cautious buyer behaviour shaped by seasonal factors and ongoing economic uncertainty. At the same time, there are early signs that market conditions are beginning to firm. The apartment segment, in particular, showed improving absorption, with lower months of inventory alongside higher sales and dollar volume.

Townhome activity held up, while detached trends remained steady, reinforcing a market that is segmented by property type but remains largely balanced overall.

This picture aligns with CREA’s outlook for 2026, which anticipates improving conditions as lower interest rates gradually draw more sidelined demand back into the market. January supports a credible case for a stronger spring market if rate reductions continue to ease affordability pressures.